Annual rate of depreciation formula

An annual percentage rate APR is the annual rate charged for borrowing or earned through an investment and is expressed as a percentage that represents the actual. A P 1 - R100 n.

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

. Accounting Rate of Return - ARR. APR refers to the inerest rate for a whole year of a loan. Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion.

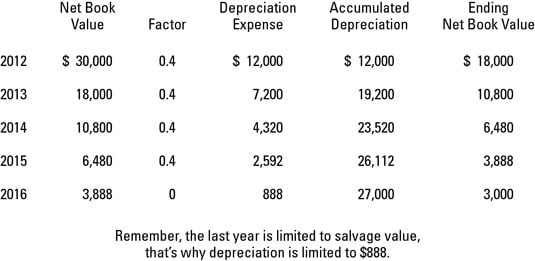

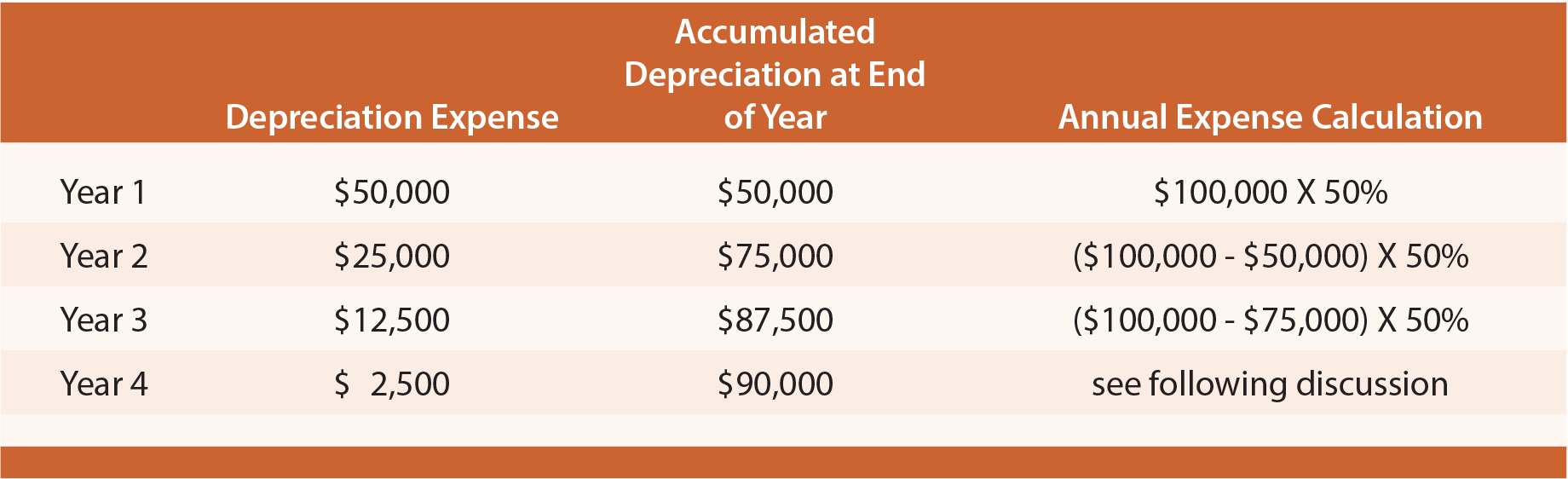

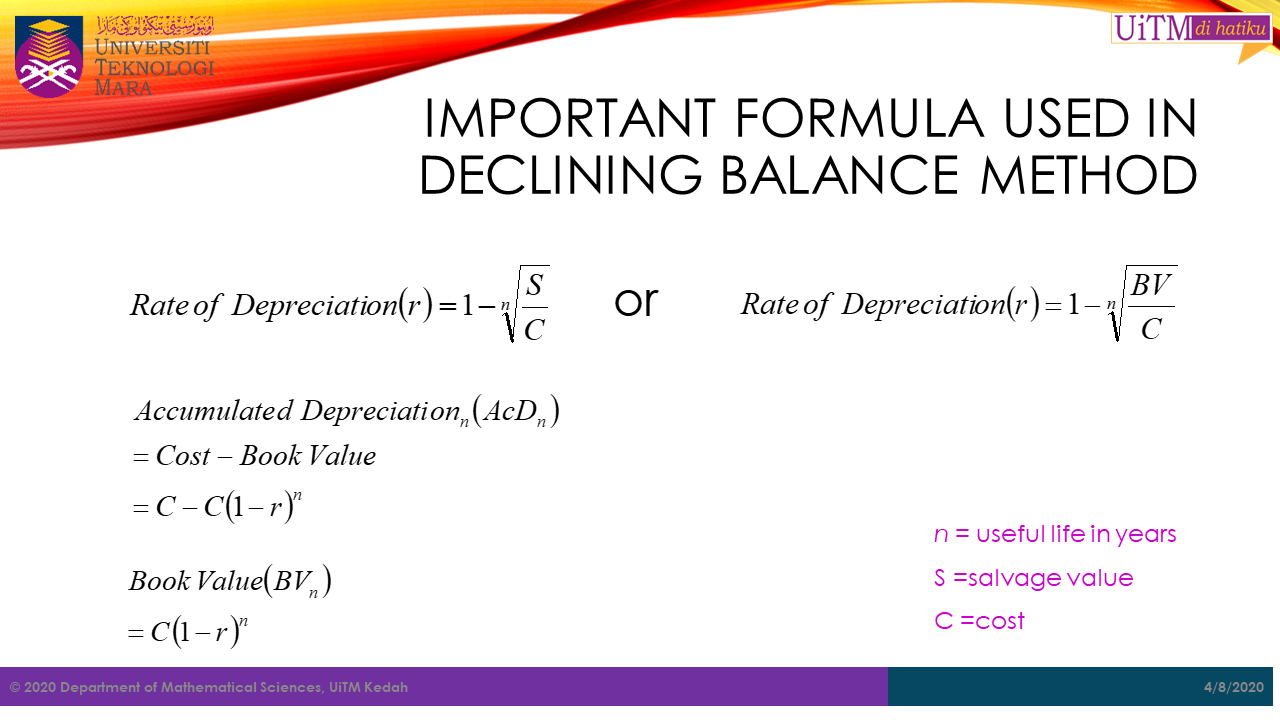

Accounting rate of return divides the. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Explanation of Straight Line Depreciation Formula.

Subtract the past date CPI from the current date CPI and divide your answer by the past date CPI. Such assets include mutual funds stocks and fixed deposits. For example if you are loaned 1000 and pay back 1100 over the course of a year your APR is 10.

The formula for calculating APR is A P1rt where A total accumulated amount P principal amount r interest rate and t time period. The average car. Read more on investment ROI then raising the result to the power of reciprocity of the tenure of investment.

Diminishing balance or Written down value or Reducing balance Method. In our example the required investment is 8475 and the net annual cost saving is 1500. The formula for depreciation under the straight-line method can be derived by using the following steps.

The installation of machine will cost 8475 and will reduce the annual labor cost by 1500. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Formula for Straight-line depreciation method Cost of an asset - Residual valueuseful life of an asset.

The formula can also be expressed by adding one to the absolute return Absolute Return Absolute return refers to the percentage of value appreciation or depreciation of an asset or fund over a certain period. The straight Line Depreciation formula assumes that the benefit from. D P - A.

What is the formula for calculating APR. Depreciation 2 35 million 070 million 10. Read more which can be calculated as per below.

The minimum required rate of return is 15. Annual Percentage Rate - APR. Formula of internal rate of return factor.

Now that you have your numbers simply utilize the formula provided. After youve calculated the straight-line depreciation you can calculate its rate by dividing one by the assets lifespan years. Plug your numbers into the inflation rate formula.

Finally divide the figure arrived in step 5 by the initial investment and resultant would be an annual accounting rate of return for that project. Find the straight-line depreciation rate. The Car Depreciation Calculator uses the following formulae.

Using the previous example if the computers lifespan is six years the straight-line depreciation rate would be 1 6 or 016. Your answer will be the inflation rate youre interested in. The accounting rate of return ARR is the amount of profit or return an individual can expect based on an investment made.

Depreciation 560000 Explanation. Afterward multiply the results by 100 to get a percentage. The useful life of the machine will be 10 years with no salvage value.

Depreciation Methods Dummies

Depreciation Methods Principlesofaccounting Com

Gt10103 Business Mathematics Ppt Download

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Examples With Excel Template

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

Math Sc Uitm Kedah Depreciation